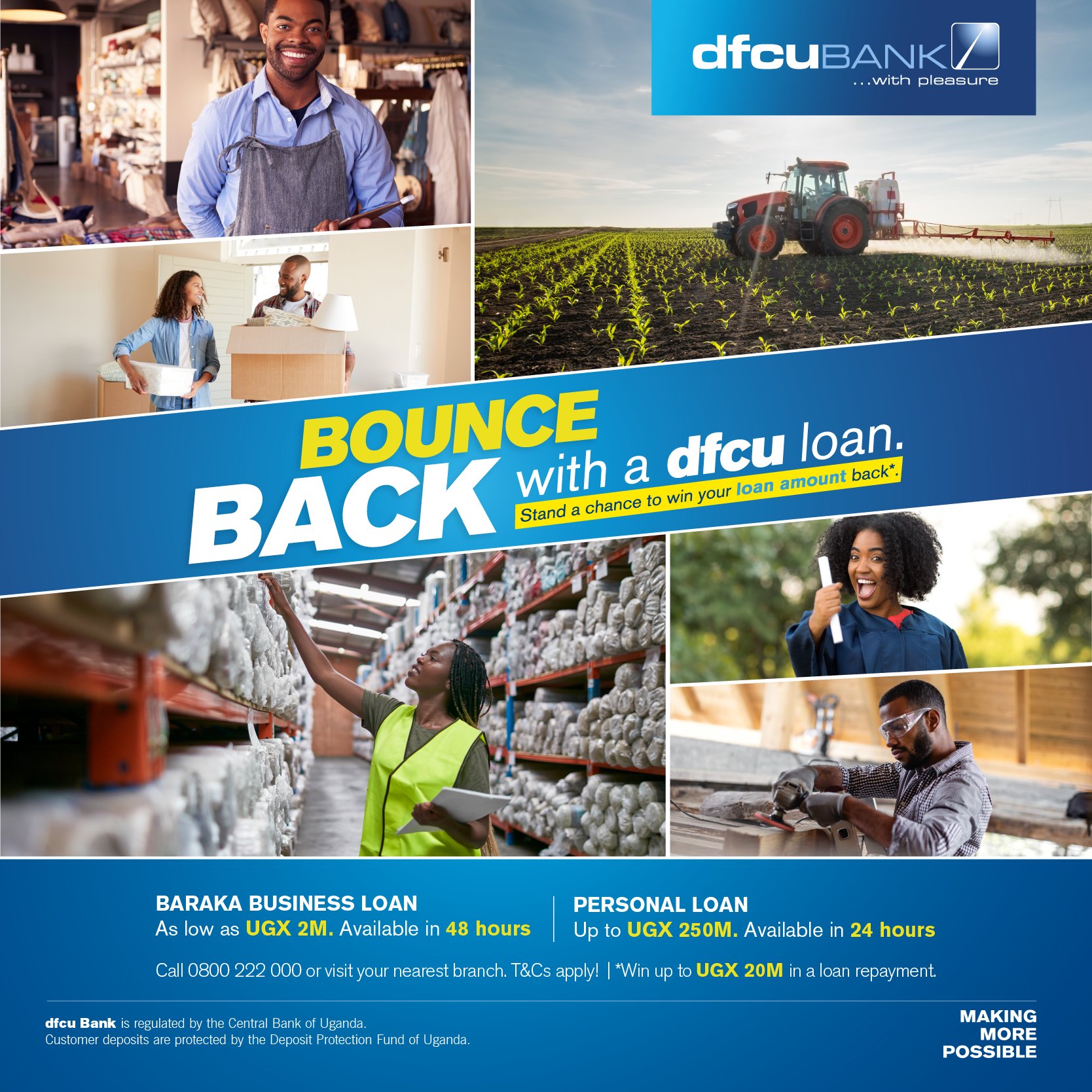

Individuals and businesses can benefit from DFCU Bank’s affordable and unsecured loan products with the launch of the ‘Bounce Back campaign’ aimed at giving customers a boost at getting back on track following the upset of the COVID-19. The campaign complements the long standing DFCU promise of ‘Making more Possible’ for Ugandans.

Customers will be able to access “Personal Unsecured Loans” of up to UGX 250,000,000 within 24 hours without having to put up the security normally expected of borrowers. Similarly, small businesses can now apply for a ‘DFCU Baraka Business Loan’ of between UGX 2 million and UGX 30 million with flexible security requirements and access funding within 48 hours.

With the ongoing challenges posed by the knock-on effects of the pandemic, DFCU recognizes and celebrates the resilience of Ugandans and would like to do more in supporting the recovery process. The ‘Bounce Back’ campaign is about focusing on supporting businesses and individuals to ‘restart and thrive’ despite the challenging times.

“As part of the campaign we are offering our customers and Ugandans dedicated loans to help them financially get back on track this year. Individuals, will benefit from our unsecured personal loans to not only take care of things that can’t wait for example school fees but also resuscitate personal long-term projects for example acquiring a new home, improving their home and so much more,” says Robert Wanok, Head Personal and Business Banking.

“We also recognize that small businesses are a major source of employment and livelihood for many Ugandans and require support in restocking their businesses and addressing other urgent working capital requirements during this period. To support them, we will offer the DFCU Baraka loan which is a short-term business loan with very flexible security requirements,” Wanok added.

According to Miranda Bageine Musoke, Head Personal Banking, “Customers who apply for the personal and business loans, will get funding within 24hrs and 48hrs respectively. Those who currently bank elsewhere and would like to move their loans to us, will get a 100% discount on arrangement fees effectively incurring no cost at all, while customers who apply for a personal and top up on an existing facility will get a 50% discount on the standard loan arrangement fees.

Miranda adds,” For the duration of the campaign that runs until May 2021, there will be monthly draws where any individual or small business that takes a DFCU loan will have a chance to win back their loan amount (up to a maximum of Ugx 20 million), for purposes of repaying the loan; in effect customers have a chance to win a loan that they don’t have to pay back. This is one of the ways DFCU is making it possible for our customer to Bounce Back!

As part of the campaign DFCU has also rolled out a Media Bounce Back challenge that will have five (5) lucky journalists walk away with UGX 1 million each by simply submitting short stories on challenges faced in 2020 on account of the pandemic and how you propose to bounce back in 2021.

Stories could be in a submission of not more than 500 words for a writeup, or video/ even audio of about 2minutes on the similar topic and submit online at bouncebankwithdfcu@dfcugroup.com. This promotion is intended to encourage journalists to explore the possibilities of the new year in spite of the challenges they may have faced in 2021 and as a way of also giving back to the media fraternity. The media promotion is only open to journalists and will run until the 30th of March 2021.